What is swap in Forex?

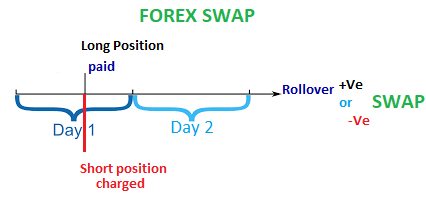

Swap is an interest fee that is either paid or charged to you at the end of each trading day. When trading on margin, you receive interest on your long positions, while paying interest on short positions. The net interest difference is known as the carry and traders seeking to profit from this are known as carry trades.

Can I make money from the swap in Forex trading?

If you’re interested in placing a carry trade, the first step is finding a high yielding and low yielding forex currency pair. Some examples of low yielding (or funding currencies) are the Japanese Yen (JPY), the Swiss Franc (CHF) and the Euro (EUR). As far as high yielding currencies go, the Dollar (AUD) and New Zealand Dollar (NZD) are popular, though more advanced carry traders might look to the South African Rand (ZAR) or other exotic currencies.

Let’s use the Euro and Dollar: rates in the Eurozone are currently below 0, whilst interest rates are relatively higher, currently 2%. This means that there is an opportunity to earn carry buying AUD with EUR ie going short EURAUD. Great, simple right?

Sadly it’s not that easy – there is no point earning a pip a day in a swap if the pair is moving against you 100 pips/week. That is, if we wanted to perform a carry trade on EURAUD, we would wait until the pair was trending down, sell into any strength, and hold for the length of the downtrend.

Think of swap as an added bonus or incentive for holding a trade long term (or in the case of the negative swap, a deterrent).

WHERE TO CONTACT US

Website :https://forextrade1.co/

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info@forextrade1.com