The US dollar and other safe-haven currencies gained yesterday and today in Asia, while the risk-linked ones slid alongside the equity market following headlines over a new, possibly vaccine-resistant coronavirus variant. As for the calendar, there are no top-tier data, but it is worth mentioning that it is “Black Friday” around the world, with consumption having the potential to boost upcoming retail sales data.

Safe Havens Rally, Risk Assets Tumble on New and Stronger COVID Variant

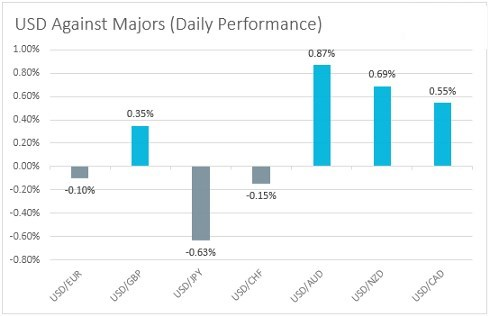

The US dollar traded higher against the majority of the other major currencies on Thursday and during the Asian session Friday. It gained versus AUD, NZD, CAD, and GBP in that order, while it lost ground versus JPY, CHF, and EUR.

The picture in the FX sphere clearly points to market sentiment deteriorating at some point during the day, or today in Asia. Indeed, turning our gaze to the equity world, we see that most EU indices traded in the green, but today in Asia, investors abandoned stocks, with the four indices under our radar falling on average 1.78% each. Wall Street stayed closed in celebration of the Thanksgiving Day, but the futures market points to a decent negative gap at today’s opening. At this point, it is worth mentioning that Wall Street will close early today.

Yesterday, we noted that European shares may stay under pressure for a while more, and we stick to that view. We believe that the increasing COVID cases and the new measures around the bloc will keep investors concerned over the future performance of the Euro-area economy. In our view, yesterday’s rebound was just a short-covering bounce. With news later in the day pointing to the detection of a new and possibly vaccine-resistant variant, we see the case for another slide, perhaps as early as today. After all, Asian markets suffered their sharpest drop in two months overnight due to that.

The only market for which we will alter our view for now is the US stock market. Remember that, despite the increasing expectations over a potential Fed hike mid next year, we have been saying that Wall Street could climb towards new highs if economic data continue to suggest that the US economy is performing better than other major economies. However, the announcement of a possibly vaccine-resistant coronavirus mutation could spark fears there as well and result in a decent correction lower.

As for the currencies, we stick to our guns that the US dollar will perform very well, but now, with investors seeking shelter to any safe-haven asset, we would expect the yen and franc to benefit as well. At the same time, the risk-linked currencies Aussie, Kiwi, Loonie, and even the British pound, could stay under some selling interest. We believe that monetary policy divergences will take the back seat for now, while the strategy of each central bank could even be altered in the foreseeable future if the COVID situation worsens.

Nikkei 225 — Technical Outlook

Japan’s Nikkei 225 cash index tumbled overnight, breaking below the key support zone of 28973, marked by the low of November 10th. The move confirmed a forthcoming lower low on the daily chart and signaled the exit of the sideways range the index had been trading within since October 29th, between that barrier and the psychological zone of 30000.

In our view, the bears could soon aim for the 28465 territory, which stopped the index from moving lower between October 21st and 28th, the break of which could extend the fall towards the 27990 area, which acted as a strong support between October 8th and 13th. If that barrier is not able to halt the slide either, then we may experience extensions towards the low of October 7th, at 27575.

In order to start examining the bullish case, we would like to see a recovery all the way above the round number of 30000. This will confirm a forthcoming higher high on the daily chart and may allow advances towards the 30400 zone, marked by the high of September 27th. If the bulls are not willing to stop there, then we could see them aiming for the 30645 hurdle, or the 30800 zone, defined by the highs of September 16th and 14th respectively.

AUD/JPY — Technical Outlook

AUD/JPY fell sharply as well, breaking below the 82.10 level, which is near the low of November 19th, thereby confirming a forthcoming lower low on both the 4-hour and daily charts. Overall, the pair remains below the downside resistance line taken from the high of November 4th, and thus, we would consider the short-term picture to be negative.

We expect the bears to challenge the 81.35 level soon, which provided resistance back on October 5th and 6th, the break of which could extend the fall towards the low of October 6th, at 80.55. Another break, below 80.55, could pave the way towards the low of October 1st, at 79.90.

On the upside, we would like to see a break above 83.35 before we consider a bullish reversal. This would not only confirm the break above the aforementioned downside line, but also a forthcoming higher high. The rate could then travel towards the 84.15 or 84.50 zones, marked by the high of November 16th and the inside swing low of November 3rd respectively. If neither zone is able to stop the bulls from climbing further, then we could see them targeting the high of November 4th, at 85.20.

As for Today’s Events

The holiday shopping season officially starts, with “Black Friday” sales around the globe. Although we will not get any instant numbers over how strong consumer spending was, we will closely watch the upcoming retail sales data.

We don’t have any top-tier data releases on today’s agenda, but we will get to hear from ECB President Lagarde, as well as by ECB members Panetta and Schnabel.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

WHERE TO CONTACT US

Website : https://forextrade1.co/

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info@forextrade1.com

Discord : https://discord.gg/vEk98ZvrHP