The foreign exchange market comprises a multitude of factors that demand careful consideration. In a world where more than 6.6 trillion dollars are traded each day on the forex market, it is essential that forex traders possess a thorough understanding of all the terms associated with forex to stay on the safe side of the shore. Forex Drawdown is one of those important technical terms associated with forex trading.

In forex trading, drawdowns refer to the difference between a high and low point in your account balance. Understanding drawdown is just as vital as understanding margin, forex leverage, currency pairs, and other standard terms in forex. In this article, we look at exactly what drawdown in Forex trading is and discuss how to control it in order to prevent losses.

What is a Drawdown in Forex Trading?

Drawdown is an essential part of Forex trading and is a valuable metric to determine the health of your trading portfolio. Knowing how to control it will help you have a successful trading career. A drawdown (DD) in forex trading refers to the percentage of the money you have lost from your trading account balance when making a particular trade.

A forex trader experiences a drawdown when losing equity on their account in a trading period. It is the amount that has been drawn from your account following the losses in forex trading. You will not face a drawdown unless you lose money on the trade.

A drawdown is bound to happen sooner or later, no matter what strategy you use to trade forex. In the forex market, you experience a drawdown whenever your balance declines.

For example, let’s say you open a currency trading account with $50,000. Following a bad trade, you see your account equity drop to $45,000. In other words, your account has been hit by a $5,000 drawdown.

Remember that a drawdown is part of trading, and you can’t avoid it, but you can keep it under control. A successful trader comes up with a trading plan that allows for withstanding periods of losses through applying solid risk management. A trading plan which is 70% profitable seems very good to have. It means that you can encounter a 30% loss while keeping the overall trading activity 70% profitable.

How to Calculate Forex Drawdown?

A drawdown is a measuring tool commonly used by all types of investors, including forex traders, in order to determine the potential risk involved in an investment. Forex traders typically use the drawdown function to monitor and measure the performance of their trading strategies.

The drawdown is usually shown as a percentage (%) and is plotted over time to show change over time. It represents a loss or potential loss in the value of an investment, usually after a series of losing trades. Due to its direct link to performance and risk management, many forex traders use drawdown as a tool to identify weaknesses in their trading strategy.

Generally, the forex drawdown is calculated by comparing the peak and trough values of the overall capital. A drawdown might look like this on your trading account:

The Peak is the highest point in time, and the Through is the lowest point after the Peak. A drawdown % of your portfolio can be calculated by subtracting the peak from the trough using the formula below.

Drawdown Formula:

Below is a statistical formula for calculating the drawdown amount or % of a specific investment or portfolio.

Where:

D(T) = Drawdown Time

t = Peak

T = Trough X = Variables

Drawdown Example:

For a simple explanation of how drawdown is calculated, let’s say, for example, you have a $10000 trading portfolio. The equity in your account drops to $8000 after a bad trade or a losing streak.

Answer: You lose $2000. The account decreased from $10000 to $8000 reflecting a 20% decrease.

10000 (Peak) – 8000 (Through) = (2000 ÷ 10000) × 100 = 20%

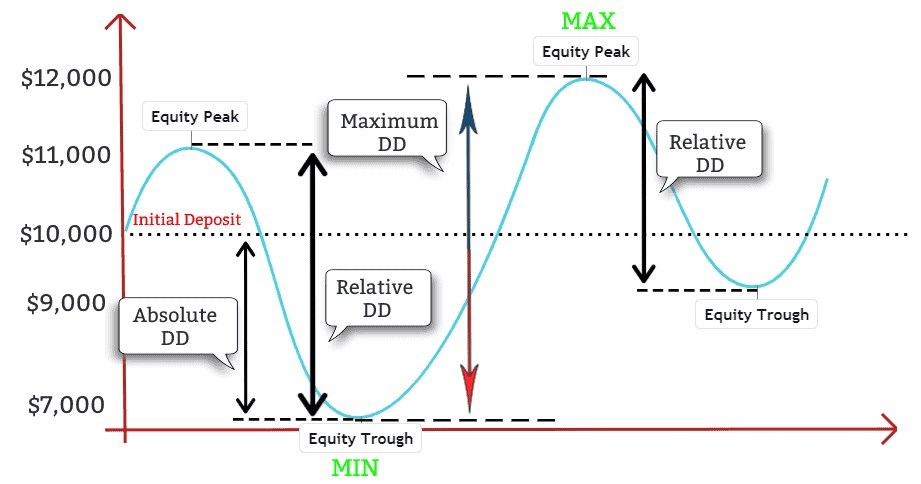

Types of Forex Drawdown

Drawdowns used in forex trading can be divided into three types. These terms are crucial for checking the performance of a portfolio before investing or trading. Furthermore, we can use these different types of drawdowns to determine the potential losses of capital that we might face if we were to use this trading system.

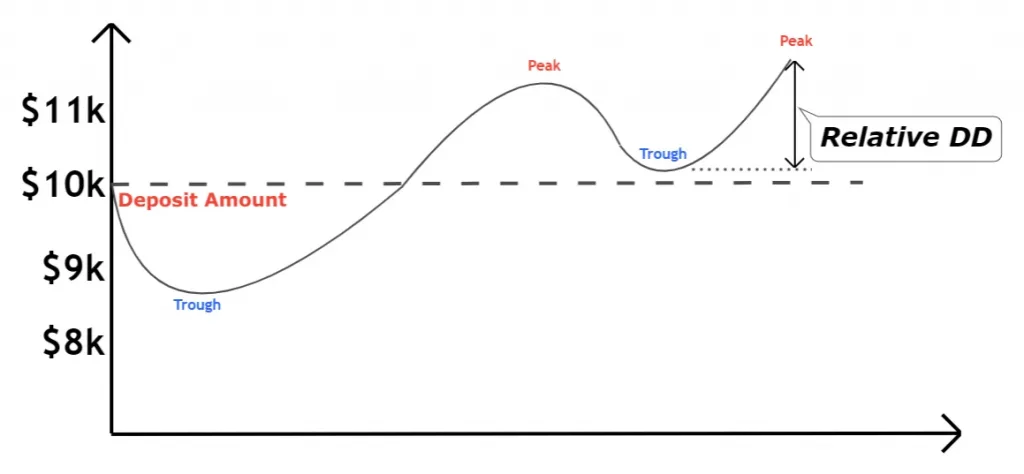

◾ Relative Drawdown

A relative drawdown reflects unrealized losses. As long as you hold onto your position, drawdowns are temporary and only become apparent once your stop-loss is triggered or when you close your position.

Relative drawdown is the difference between the maximum equity high to maximum equity low, it is not fixed as it is measured on the equity.

Relative Drawdown = Maximum value of equity – Minimum value of equity

Relative Drawdown in % = (Max equity value – Min equity value) / (max equity value) ×100

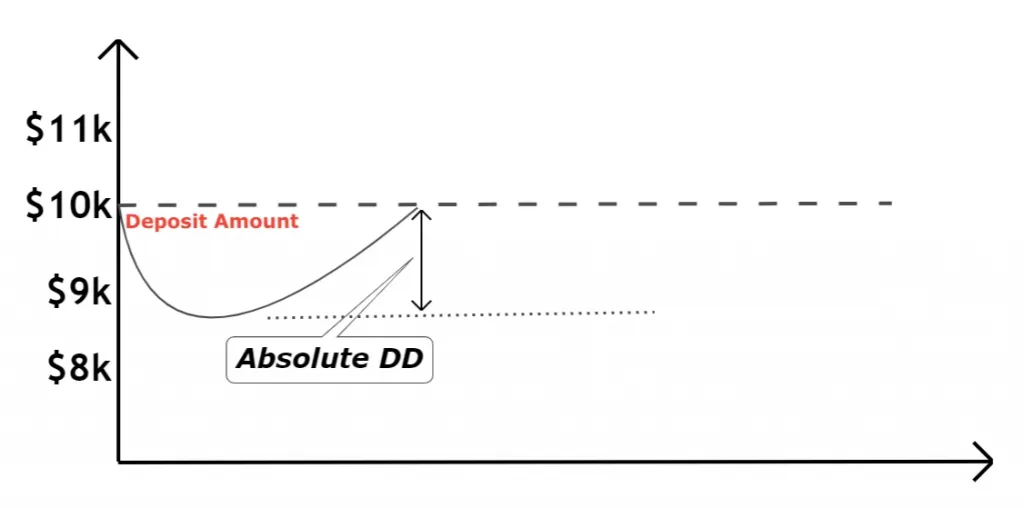

◾ Absolute Drawdown

Absolute drawdown represents the difference between the initial deposit and the smallest equity value, showing how much the equity has fallen below the deposit level. The absolute drawdown only occurs when the account value drops below the initial deposit.

Absolute Drawdown formula = Initial Deposit– smallest equity value

Absolute Drawdown in % = (Initial Deposit – smallest equity value) / (Initial Deposit) ×100

Absolute Drawdown helps to evaluate the results of a trading account.

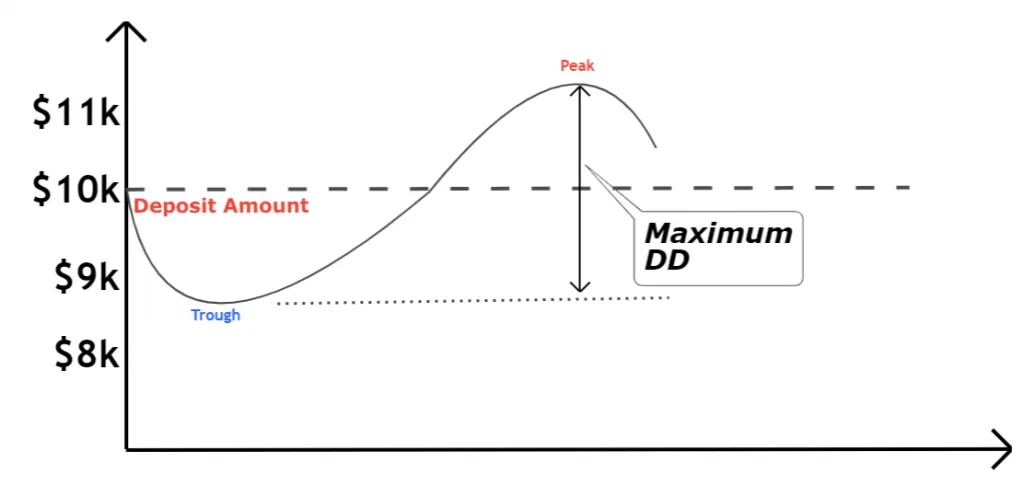

◾ Maximum Drawdown

Maximum drawdown is the difference between an all-time high to the all-time low of an account balance.

Max Drawdown Formula = All-time high balance – All-time low balance

Max DD in %= (All-time high balance – All-time low balance) / (All-time high balance) ×100

Maximum drawdown indicates potential downside risk over a given period.

Lessons you can learn from a Drawdown

All forex traders experience drawdowns at some point in time. The fact is, Forex is a highly volatile and unpredictable market, and traders cannot completely avoid risking their capital. Even if you believe your trade is sound, there is an inheritance risk of losing money.

One of the most significant factors distinguishing experienced or successful forex traders from inexperienced traders is their ability to deal with the drawdown. Typically, a knowledgeable trader always places a high value on managing risk, as they constantly monitor their trading portfolio and positions.

Forex traders should manage their drawdowns carefully in order to be successful. There’s more to protecting your capital by minimizing losses or drawdowns than buying and selling currencies for profit to become a successful forex trader. You need to master your drawdown in order to become a successful forex trader.

You may have lost money because of mistakes in trading this time, but hopefully, you’ll learn from them and do better next time. The process of facing drawdowns in trading helps you to understand whether your trading strategies are likely to survive over the long run. Having a drawdown is common, and sometimes it is best to accept the loss and adjust your strategy to move forward to profitable trading.

Best Strategies to Control a Forex Drawdown

All types of trading can result in a drawdown, and failing to recognize and learn from them will only result in more difficulties and losses. A forex trader should never underestimate the importance of controlling drawdowns. It is necessary to remain profitable.

The following are the best strategies forex traders can employ to control drawdowns:

- It’s critical to learn how to deal with the psychological turmoil associated with drawdown. It’s crucial to maintain positive trading psychology to make better decisions.

- Try reducing trade size or leverage. Leverage is a double-edged sword, as it increases both profits and losses. Holding positions for longer periods exposes a portfolio to market risks and can cause drawdowns.

- A guaranteed stop-loss order (GSLO) can also reduce drawdown. By using GSL orders, you can ensure that your stop loss will be executed without slippage at the desired price.

- Setting a daily loss limit also minimizes the losses on a single day. Once you reach the daily loss threshold, you need to stop trading for the rest of the day and only resume trading the following day.

- Place a stop-loss directly on your account balance. Traders might also want to make use of an account equity stop loss in addition to traditional stop-loss mechanisms. If this stop is triggered, all open positions will automatically be closed at market price.

Where to contact us :

Website : www.forextrade1.co

Twitter : www.twitter.com/forextrade11

Telegram : telegram.me/ftrade1

Facebook : www.facebook.com/Forextrade01

Instagram : www.instagram.com/forextrade1

YouTube : www.youtube.com/ForexTrade1

Skype : forextrade01@outlook.com

Email ID : info.forextrade1@gmail.com

Discord : https://discord.gg/vEk98ZvrHP

LinkedIn : https://www.linkedin.com/company/forextrade11